Air Products Announces Preliminary Q1FY25 GAAP EPS of $2.77 and Adjusted EPS of $2.86, Exceeding Company’s Previous Adjusted EPS Guidance for the Quarter

Company to Release Full Q1FY25 Results and Host Teleconference on February 6, 2025

Media Contacts:

Investor Contacts:

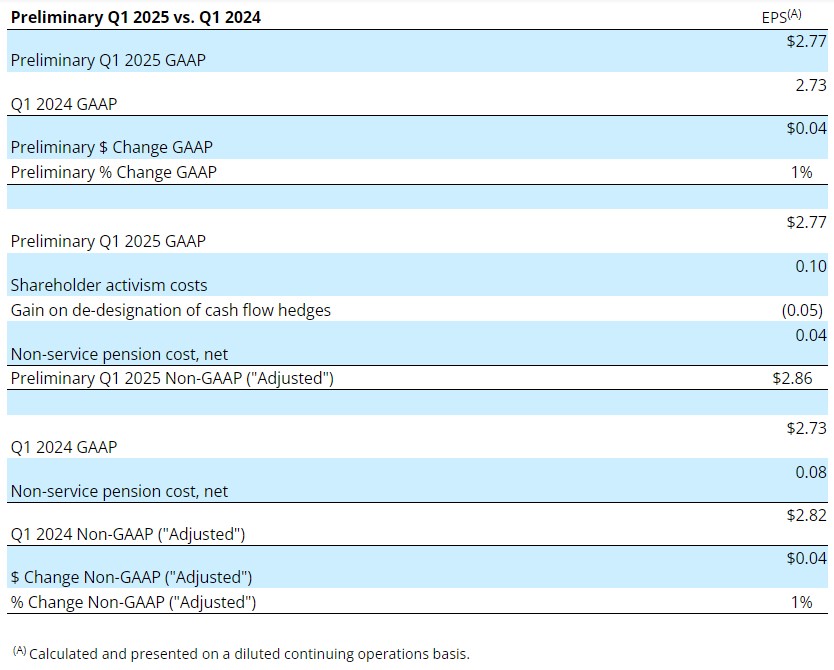

Air Products (NYSE:APD) today announced preliminary fiscal 2025 first quarter GAAP earnings per share# (“EPS”) of $2.77 and preliminary fiscal 2025 first quarter adjusted EPS* of $2.86. Preliminary adjusted EPS exceeds the top end of the Company’s previous fiscal 2025 first quarter adjusted EPS guidance* of $2.75 to $2.85.

Full interim consolidated financial statements as of and for the quarter ended December 31, 2024 are not yet complete as of the date of this press release. The preliminary earnings per share information presented above is based upon information available as of the date of this press release and is subject to change upon completion of all quarter-end close processes, as well as the possible occurrence of interim events prior to the issuance of our full financial statements. Accordingly, undue reliance should not be placed on this preliminary unaudited financial information. Please also refer to the “Forward-Looking Statements” provided below.

The Company will release its full Q1FY25 financial results prior to market open on Thursday, February 6, 2025 and review these results in a teleconference at 8:00 a.m. ET. The teleconference will be open to the public and the media in listen-only mode by telephone and Internet broadcast.

Live teleconference: 773-305-6853

Passcode: 3870353

Internet broadcast/slides: Available on the Event Details page on Air Products’ Investor Relations website.

Internet replay: Available on the Event Details page on Air Products’ Investor Relations website.

#Preliminary earnings per share is calculated and presented on a diluted basis from continuing operations attributable to Air Products.

*Preliminary results in this release reference adjusted EPS, which is a non-GAAP financial measure. Additional information regarding this measure and a reconciliation of GAAP EPS to adjusted EPS is provided below. The Company previously provided fiscal 2025 first quarter adjusted EPS guidance in Exhibit 99.1 to its Current Report on Form 8-K dated November 7, 2024 (the “Prior Earnings Release”). Management is unable to reconcile, without unreasonable effort, the Company’s forecasted range of adjusted EPS to a comparable GAAP range. Air Products provides adjusted EPS guidance on a continuing operations basis, excluding the impact of certain items that management believes are not representative of the Company's underlying business performance, such as the incurrence of costs for cost reduction actions and impairment charges, or the recognition of gains or losses on certain disclosed items. It is not possible, without unreasonable efforts, to predict the timing or occurrence of these events or the potential for other transactions that may impact future GAAP EPS. Furthermore, it is not possible to identify the potential significance of these events in advance, but any of these events, if they were to occur, could have a significant effect on the Company's future GAAP results.

About Air Products

Air Products (NYSE:APD) is a world-leading industrial gases company in operation for over 80 years focused on serving energy, environmental, and emerging markets and generating a cleaner future. The Company supplies essential industrial gases, related equipment and applications expertise to customers in dozens of industries, including refining, chemicals, metals, electronics, manufacturing, medical and food. As the leading global supplier of hydrogen, Air Products also develops, engineers, builds, owns and operates some of the world's largest clean hydrogen projects, supporting the transition to low- and zero-carbon energy in the industrial and heavy-duty transportation sectors. Through its sale of equipment businesses, the Company also provides turbomachinery, membrane systems and cryogenic containers globally.

The Company had fiscal 2024 sales of $12.1 billion from operations in approximately 50 countries and has a current market capitalization of about $65 billion. Approximately 23,000 passionate, talented and committed employees from diverse backgrounds are driven by Air Products’ higher purpose to create innovative solutions that benefit the environment, enhance sustainability and reimagine what's possible to address the challenges facing customers, communities, and the world. For more information, visit airproducts.com or follow us on LinkedIn, X, Facebook or Instagram.

Cautionary Note Regarding Forward-Looking Statements

This release contains “forward-looking statements” within the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including statements about earnings and capital expenditure guidance, business outlook and investment opportunities. Forward-looking statements are based on management’s expectations and assumptions as of the date of this release and are not guarantees of future performance. While forward-looking statements are made in good faith and based on assumptions, expectations and projections that management believes are reasonable based on currently available information, actual performance and financial results may differ materially from projections and estimates expressed in the forward-looking statements because of many factors, including, without limitation: changes that could result from the completion of all quarter-end close processes or interim events that could arise prior to the issuance of our full unaudited financial statements; changes in global or regional economic conditions, inflation, and supply and demand dynamics in the market segments we serve, including demand for technologies and projects to limit the impact of global climate change; changes in the financial markets that may affect the availability and terms on which we may obtain financing; the ability to execute agreements with customers and implement price increases to offset cost increases; disruptions to our supply chain and related distribution delays and cost increases; risks associated with having extensive international operations, including political risks, risks associated with unanticipated government actions and risks of investing in developing markets; project delays, scope changes, cost escalations, contract terminations, customer cancellations, or postponement of projects and sales; our ability to safely develop, operate, and manage costs of large-scale and technically complex projects; the future financial and operating performance of major customers, joint ventures, and equity affiliates; our ability to develop, implement, and operate new technologies and to market products produced utilizing new technologies; our ability to execute the projects in our backlog and refresh our pipeline of new projects; tariffs, economic sanctions and regulatory activities in jurisdictions in which we and our affiliates and joint ventures operate; the impact of environmental, tax, safety, or other legislation, as well as regulations and other public policy initiatives affecting our business and the business of our affiliates and related compliance requirements, including legislation, regulations, or policies intended to address global climate change; changes in tax rates and other changes in tax law; safety incidents relating to our operations; the timing, impact, and other uncertainties relating to acquisitions, divestitures, and joint venture activities, as well as our ability to integrate acquisitions and separate divested businesses, respectively; risks relating to cybersecurity incidents, including risks from the interruption, failure or compromise of our information systems or those of our business partners or service providers; catastrophic events, such as natural disasters and extreme weather events, pandemics and other public health crises, acts of war, including Russia’s invasion of Ukraine and new and ongoing conflicts in the Middle East, or terrorism; the impact on our business and customers of price fluctuations in oil and natural gas and disruptions in markets and the economy due to oil and natural gas price volatility; costs and outcomes of legal or regulatory proceedings and investigations; asset impairments due to economic conditions or specific events; significant fluctuations in inflation, interest rates, and foreign currency exchange rates from those currently anticipated; damage to facilities, pipelines or delivery systems, including those we are constructing or that we own or operate for third parties; availability and cost of electric power, natural gas, and other raw materials; the success of productivity and operational improvement programs; and other risks described in our Annual Report on Form 10-K for the fiscal year ended September 30, 2024 and subsequent filings we have made with the U.S. Securities and Exchange Commission. You are cautioned not to place undue reliance on our forward-looking statements. Except as required by law, we disclaim any obligation or undertaking to update or revise any forward-looking statements contained herein to reflect any change in assumptions, beliefs, or expectations or any change in events, conditions, or circumstances upon which any such forward-looking statements are based.

ADJUSTED EARNINGS PER SHARE

(Millions of U.S. Dollars unless otherwise indicated, except for per share data)

We view adjusted earnings per share (“EPS”) as a key performance metric and provide this non-GAAP financial measure to allow investors, potential investors, securities analysts, and others to evaluate the performance of our business in the same manner as our management. We believe this measure, when viewed together with financial results computed in accordance with U.S. generally accepted accounting principles (“GAAP”), provides a more complete understanding of the factors and trends affecting our historical financial performance and projected future results. However, we caution readers not to consider this measure in isolation or as a substitute for EPS presented in accordance with GAAP. Readers should also consider the limitations associated with this non-GAAP financial measure, including the potential lack of comparability of this measure from one company to another.

We calculate adjusted EPS by adjusting GAAP EPS to exclude certain items that we believe are not representative of our underlying business performance. For example, we exclude the impact of the non-service components of net periodic benefit/cost for our defined benefit pension plans. Non-service related components are recurring, non-operating items that include interest cost, expected returns on plan assets, prior service cost amortization, actuarial loss amortization, as well as special termination benefits, curtailments, and settlements. Adjusting for the impact of non-service pension components provides management and users of our financial statements with a more accurate representation of our underlying business performance because these components are driven by factors that are unrelated to our operations, such as volatility in equity and debt markets. Further, non-service related components are not indicative of our defined benefit plans’ future contribution needs due to the funded status of the plans. Additionally, during the first quarter of fiscal year 2025, we excluded costs associated with our response to actions of activist shareholders, which are not associated with the ongoing operation of our business and are difficult to predict in future periods. We may also exclude certain expenses associated with cost reduction actions and impairment charges as well as gains on disclosed transactions. The reader should be aware that we may recognize similar losses or gains in the future.

The tax impact of our pre-tax non-GAAP adjustments reflects the expected current and deferred income tax impact of our non-GAAP adjustments. These tax impacts are primarily driven by the statutory tax rate of the various relevant jurisdictions and the taxability of the adjustments in those jurisdictions.

NON-GAAP ADJUSTMENTS

In addition to the recurring impact of non-service related components of our defined benefit pension plan, our preliminary first quarter adjusted EPS is adjusted for the items described below.

Shareholder Activism Costs

During the first quarter of fiscal year 2025, we incurred costs of $29.9 ($21.9 after tax, or $0.10 per share) in connection with our response to a proxy contest led by activist shareholder, Mantle Ridge L.P. These costs include legal and other professional service fees as well as incremental proxy solicitation costs related to the 2025 Annual Meeting of Shareholders.

De-designation of Cash Flow Hedges

During the third quarter of fiscal year 2024, we discontinued cash flow hedge accounting for certain interest rate swaps designed to hedge long-term variable rate debt facilities during the construction period of the NEOM Green Hydrogen Project. These swaps are held by NEOM Green Hydrogen Company, a consolidated joint venture accounted for under the variable interest model, of which Air Products owns a one-third interest. We expect the affected swaps to remain de-designated until outstanding borrowings from the available project financing are commensurate with the notional value of the instruments, at which time these instruments may re-qualify for cash flow hedge accounting. As a result of the de-designation, we recognized an unrealized gain of $38.8 ($10.3 attributable to Air Products after tax, or $0.05 per share) during the first quarter of fiscal year 2025. The amount of the unrealized gain attributable to our noncontrolling partners was $25.2.

We expect to recognize changes to the fair value of the impacted instruments through earnings in future periods until they re-qualify for cash flow hedge accounting. It is not possible to predict the significance of adjustments in future periods given potential interest rate volatility.

RECONCILIATION OF ADJUSTED EPS

The table below reconciles adjusted EPS to GAAP EPS, the most directly comparable GAAP measure. In periods that we have non-GAAP adjustments, we believe it is important for the reader to understand the per share impact of each such adjustment because management does not consider these impacts when evaluating underlying business performance. Per share impacts are calculated independently and may not sum to total EPS and total adjusted EPS due to rounding.

First quarter 2025 GAAP EPS and adjusted EPS are preliminary based upon information available as of the date of this report and is subject to change and finalization based on completion of all quarter end close processes.